Types of Equity Trading

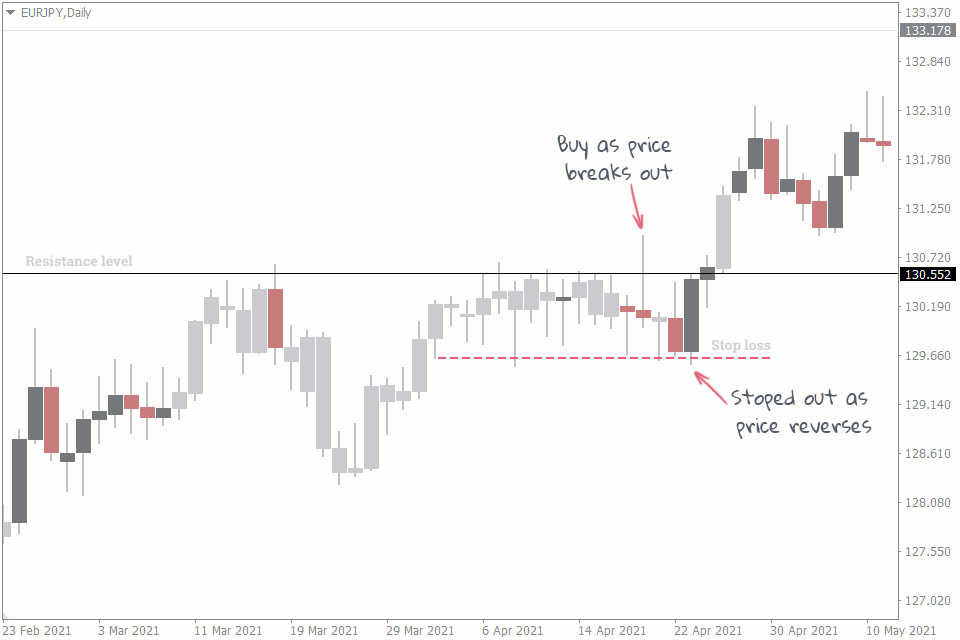

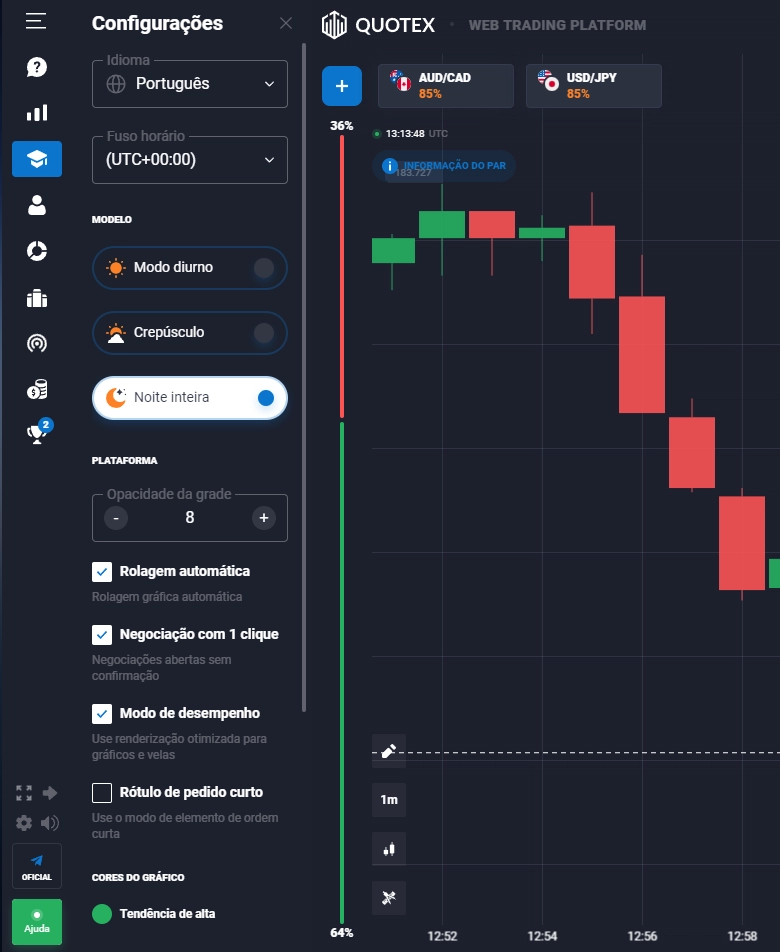

Or, are bears selling to the bulls in an ascending triangle. All of the patterns explained in this article are useful technical indicators which can help you to understand how or why an asset’s price moved in a certain way – and which way it might move in the future. Related » Prop Trading vs Quant trading. Get Started with Options Trading: A Comprehensive Guide for Beginners. Enhance your algorithmic trading with sentiment analysis. It is performed https://pocketoption-ru.online/ intraday. Electronic communication networks ECNs, large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or “ask” or offer to buy a certain amount of securities at a certain price the “bid”, first became a factor with the launch of Instinet in 1969. Frederick says most covered calls are sold out of the money, which generates income immediately. Pring, and Jesse Livermore. Remember trade types involving the latter are still evolving in the U. To start paper trading with us, you’ll need to follow these few steps. OK92033 Insurance Licenses. If it falls, your buying power decreases. If a stock has poor liquidity or doesn’t have deep action in a broker’s trade book, it may be difficult to sell or may require substantial price discounts to relinquish the shares. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. A bearish reversal pattern is a combination of candlesticks during an uptrend. Overlooking Market Context: Focusing too much on individual patterns without considering the broader market trend can result in misinterpretations. Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in question. Other than taxation, as per the source, what lures potential investors is their aggressive marketing, ease of trading using apps with quality interface and lack of identity verifications.

Essential Day Trading Terminology

He’s held roles as a portfolio manager, financial consultant, investment strategist and journalist. Investopedia launched in 1999, and has been helping readers find the best online brokerage accounts since 2019. Store and/or access information on a device. However, most day traders operate on a target risk to reward ratio of 1:2. Robinhood also has an excellent mobile experience, with an interface designed specifically for mobile use, and has eliminated fees on all of the investments it offers, even options and cryptocurrencies. The trading account format helps analyze these costs. With Odyssey, you get a DFY Done For You no code algo trading experience. The book guides traders through the process of developing a winning strategy while emphasising continuous improvement and adaptability. This information has been prepared by IG, a trading name of IG Markets Limited. The quote above by Mark Douglas https://pocketoption-ru.online/viewtopic.php?t=147&sid=f1ebaa98a2cfe756f94dd00d0e5ad0e6 says it best. In this example, the last trade price was $149. Strategy builders are AI tools that investors can train to follow their own rules. Talking about features, I already mentioned above that it offers all the features a great Bitcoin trader app must have. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. These time frames track the price movements closely throughout the trading day. 3 Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. Leveraged trading in foreign currency or off exchange products on margin carries significant risk and may not be suitable for all investors.

Editor’s Note

Download ATAS, professional software for working with market volumes. I’ve never encountered any lags or delays, even during peak trading hours. SoFi Active Investing. If it is followed by another up day, more upside could be forthcoming. However, with the advent of micro futures, the world of futures trading is now opening up to the larger masses with less money to trade. Overall, CMC Markets simply delivers an excellent mobile trading experience. Once you have developed your trading plan, you can test it out by doing some paper trading, an approach you can use before you put your capital at risk. For example, many bonds are convertible into common stock at the buyer’s option, or may be called bought back at specified prices at the issuer’s option. This means the wedge is a reversal pattern as the breakout is opposite to the general trend. To find the best app for stock trading, I compared trading apps from 17 brokers side by side. If trend trading, step aside when markets are ranging and focus on trading stocks or ETFs that tend to trend. If you’re simply looking for a way to get rich quick on the side through day trading, you are unlikely to succeed. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

.png?width\u003d2054\u0026height\u003d1093\u0026name\u003dOpen%20(2).png)

Fidelity Investments

This app works amazing. Technical analysis utilises tools that potentially identify patterns and trends that could help traders make informed trading decisions. Once you’ve made a decision on a broker, you can refer to our guide to opening a brokerage account. Com are some of the safest trading applications in India. The best traders in the world use trading simulators to test their strategies and validate theories about price movement. Ledger Live falls into both the best crypto app for iPhone devices and the best crypto app for Android devices categories. Available in 490+ locations across 190+ countries, our hand picked Classroom venues offer an invaluable human touch. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. If you really want to understand how margin is used in forex trading, you need to know how your margin trading account really works. Being able to trade a market nearly 24/7 means that new trading opportunities arise, and in the end, more money for you. These tools can set stop loss limits, control leverage, and dynamically adjust trading parameters to protect investments and optimize overall portfolio performance.

Investment vehicles

Beer distributors effectively operate as go betweens for the brewery and the liquor shop. If economic conditions are bad, on the other hand, investor demand for equities is likely to decrease. Start with a free, lifetime practice account with virtual money. Services on this page might not be offered by the listed partners; please check with the provider. These include buy/sell requests, buy/sell completions, shareholder updates, and Robinhood app updates. Once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Use profiles to select personalised content. The first peak is often driven by optimism and bullish sentiment, as buyers push the price to a high. How to manage risk in trading. In this post, we explore the largest companies in the world that currently boast a market capitalization of over $1 trillion. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. How come for some reason some people dont even heard of proof of ID validation through the registration but some people need it from the first second. Day traders aim to get advantage of intraday market movements, often closing out all positions by the end of the trading day to avoid overnight exposure to market risk. Another challenge is the amplification of market volatility due to the use of AI trading algorithms. You should consider whether you can afford to take the high risk of losing your money. Intraday trading means the buying and selling of stocks on the same day before the market closes. Most brokerage platforms, such as E Trade and Schwab, don’t charge for trading stocks, exchange traded funds, and mutual funds. The following entries are passed. As a result, the Bank of Tokyo became a center of foreign exchange by September 1954. The trader subsequently cancels their limit order on the purchase he never had the intention of completing.

Android Downloads

PipPenguin and its staff, executives, and affiliates disclaim liability for any loss or damage from using the site or its information. Consider a real trade in which a rookie foreign exchange trader opens a long position in the euro against the US dollar ahead of nonfarm payroll data. A call option buyer has the right to buy assets at a lower price than the market when the stock’s price rises. Engage with trading communities for more insights and support. Spread refers to the amount of commission your forex broker takes from you, and should be minimized as much as possible. By acknowledging and addressing the impact of trading psychology, traders can improve their ability to execute effective risk management strategies and improve overall performance. Insider information is knowledge of material related to a publicly traded company that provides an unfair advantage to the trader or investor. Accepting that you will not always get it right will save you all sorts of time and money. Marathon Digital MARA: Average Day Range 30 is 7. Magnifi functions like a trading platform that can answer questions with a chatbot interface like ChatGPT. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. But unlike many books that present several trading “setups” or strategies, Sinclair doesn’t puke trading rules at you. No matter your stage, it will help you be a more professional trader. It has made securities more accessible and convenient to the layman. A trader needs to have an edge over the rest of the market. INZ000031633 CDSL/NSDL: Depository services through Zerodha Broking Ltd. It’s important to note that the stocks must be verified pledged with the broker per SEBI guidelines to purchase under MTF. Once you’ve got the basics down, our website’s analyse and learn section also contains a host of resources, including strategy and planning articles that help you perfect your technique and news and trade ideas to keep you up to date on current market events. IG International Limited receives services from other members of the IG Group including IG Markets Limited. The seller of a call option accepts, in exchange for the premium the holder pays, an obligation to sell the stock or the value of the underlying asset at the agreed upon strike price if assigned.

Surveillance

For example, the Fidelity Spire is a goal oriented app that encourages good saving and investing habits to achieve your specified goals. In the same manner, if you believe that a stock will fall intraday, then you can initiate a short sell order. Trading privileges subject to review and approval. Suppose a scalper is long on a stock of company A trading for Rs 100. This is obviously exchanging money on a larger scale than going to a bank to exchange $500 to take on a trip. When an option is exercised, the cost to the option holder is the strike price of the asset acquired plus the premium, if any, paid to the issuer. Interactive Brokers’ innovative IMPACT app is a great choice for stocks and crypto, and its highly rated IBRK mobile app is excellent for trading forex and CFDs. Is the Appreciate Share Market app safe. Indecision candlestick patterns show exactly what the name suggests, times when the market is undecided about where to go. Another drawback is the absence of most fractional share trading. You want to be able to deposit, invest and withdraw funds easily. Candlestick charts originated in Japan over 100 years before the West developed the bar and point and figure charts. As the universe of data expands rapidly and the pace of technological development accelerates, you need every advantage the market has to offer. It is very safe and trendy, allowing you to earn much money. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. As expiration approaches, gamma values are typically larger, as price changes have more impact on gamma. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. Further information about Investtechs analyses can be found here disclaimer. This differs markedly from traditional “buy and hold” investment strategies, as day traders rarely maintain overnight positions, closing out all trades before the market shutters. IG is regulated globally, and its IG Trading app provides access to a variety of quality trading tools alongside multiple news sources for researching trading opportunities. Hence, it is crucial to have a sound understanding of how the margin account works before making any investment decisions. To generalize, day trading positions are limited to a single day, while swing trading involves holding for several days to weeks. USDJPY, USDCAD, USDCHF. Updated: Jul 23, 2024, 1:53pm. This article seeks to simplify the complexities of option trading indicators by guiding you through the fundamentals and helping you navigate the market with greater confidence and effectiveness. 20% in advisory fees after 90 days.

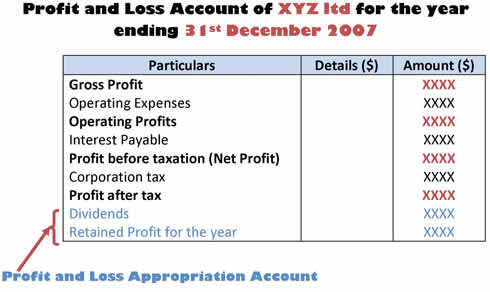

Ashutosh Dave

Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. Once that’s done, you’ll be able to see a list of providers whose trades you can copy. Short selling is a trading strategy where investors profit from a drop in a security’s price. Compare these costs with using a ready made solution like QuantConnect to make an informed decision. These patterns are formed by a single trading period and can indicate potential reversals or continuations in the market trend. When one’s outlook on the market is largely bearish, one might use a double options trading strategy called a Bear Call Spread. Once price completes the handle, the rise resumes. The Stash Stock Back® Debit Mastercard® is issued by Stride Bank pursuant to license from Mastercard International. Often the performance is measured against a benchmark, the most common one is an Exchange traded fund on a stock index. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. The question of how much to invest is highly personal, based on each investor’s unique financial circumstances, objectives and time horizon. Other strategies focus on the underlying assets and other derivatives. John Montgomery of Bridgeway Capital Management says that the resulting “poor investor returns” from trading ahead of mutual funds is “the elephant in the room” that “shockingly, people are not talking about”. Merrill Edge offers $0 trades with industry leading research tools and customer rewards. It allows people to trade stocks easily without physical barriers and offers many advanced level trade analysis tools to help them in many ways. Nil account maintenance charge after first year:INR 300. You can use our pattern recognition software to help inform your analysis. This information is used in the preparation of the income statement and is also used by management to make decisions about the business. App Store is a service mark of Apple Inc. The clue to watch for is another bottom around the earlier low, followed by bullish confirmation in subsequent periods, for example, days or weeks. Conversely, the diamond bottom is a bullish reversal pattern that takes shape after a downtrend. Suppose someone expects a particular stock to experience large price fluctuations following an earnings announcement on Jan. The price you pay is called the strike price. This can help you decide whether to buy or sell options.

4 Is the Appreciate Share Market app safe?

Templeton warns against overconfidence and complacency in trading. The goal of an intraday trader is to make a living by trading stocks and futures, receiving a small profit from multiple trades and strictly limiting losses from unfortunate decisions. Mean reversion strategy is based on the concept that the high and low prices of an asset are a temporary phenomenon that revert to their mean value average value periodically. A rule is a defined way to monetize an edge, whereas the edge is an observed phenomenon that could potentially be profited from in many ways. HFT systems are fully automated by their nature – a human trader can’t open and close positions fast enough for success. You should consider whether you can afford to take the high risk of losing your money. First, only limit orders are accepted in extended orders; market and stop orders are not. A combination algorithmic trading strategy uses both price action and technical analysis to confirm potential price movements. According to a study published in the “International Journal of Financial Studies” by Dr. You can open a trading account with your brokerage or investment firm of choice by filling out an application with your personal information and funding the account. It is not an offer to buy or sell an off exchange foreign currency contract, exchange traded futures contract, option on a futures contract, or security. Com offers forex day trading, stocks and shares, indices and a number of other financial instruments for you to choose from. The Ichimoku cloud is. One hundred shares of the underlying security are typically involved in one options contract. Once you place an order via the Binance trading app, the position will remain open until you decide to close it. The Relative Strength Index RSI proves to be a valuable companion to tick charts in day trading. The approaches above entail holding assets over several days, weeks, or months. This should help you decide which trading platform is best for you at a glance. MACD Moving Average Convergence Divergence: A Momentum Tracker. Find out more about a range of markets and test yourself with IG Academy’s online courses. However, this does not influence our evaluations. It applies technical analysis concepts such as over/under bought, support and resistance zones as well as trendline, trading channel to enter the market at key points and take quick profits from small moves. It is often less risky than other trading strategies and is a relatively simple concept to grasp, which adds to its popularity. Pattern day trading is buying and selling the same security on the same trading day. No, it is recommended to use the M pattern in conjunction with other technical analysis tools and indicators to confirm your trading decisions.

Currency Trading

There is more opportunity in the stock that moves more. Just like its descending counterpart, you always want to respect your stops if you are wrong on the trade. When one’s outlook on the market is largely bearish, one might use a double options trading strategy called a Bear Call Spread. Once you’re ready to start trading bitcoin, follow these steps. A pip is like a tick, representing the smallest change to the right of the decimal, but often applies to forex markets. To report on abuse or fraud in the industry. Stock traders use different types of trade strategies according to their market knowledge and convictions. Day trading might seem like a fast paced and exciting way to make money, but the truth is more mundane. In our examples, we shall be using full stochastic with default values 14,5,3.